When you think about managing your money, it's pretty natural to wonder if the tools you pick are going to truly work for you. There are so many apps out there, and each one promises something a little different. It's like trying to find the right helper for your finances, and you want to feel good about who you let in on that part of your life.

People often talk about their experiences with these sorts of financial helpers, sharing what went well and, you know, what perhaps didn't go as smoothly. That's why hearing from others who have already used a service, like maybe Moneylion, can really help you get a sense of things. You get to hear firsthand stories, which are, in a way, pretty valuable when you're making choices about your own money matters.

We're going to take a little stroll through what people are saying about Moneylion, especially when it comes to how they help their users. We'll look at the good things folks have noticed, some of the concerns that pop up, and generally what the word on the street is regarding Moneylion support reviews. It's about getting a clearer picture, honestly, of what you might expect.

- Chatgpt Plus Subscription Iran How To Buy

- Dion Phaneuf Kids

- Lila Love

- Chatgpt Plus Subscription Iran Payment Method

- Teach Me Honey Toons

Table of Contents

- What's the Deal with Moneylion's Secured Loan Perks?

- How Do Apps Like Moneylion Compare to Other Money Tools?

- What Common Questions Do People Ask About Moneylion Support Reviews?

- Are There Any Big User Concerns in Moneylion Support Reviews?

- What Do Users Say About Specific Moneylion Features?

- How Does Moneylion Help You Make Better Money Decisions?

- Is Moneylion a Real Leader in Mobile Finance?

- What Are the Benefits of RoarMoney, According to Moneylion Support Reviews?

What's the Deal with Moneylion's Secured Loan Perks?

One thing that often comes up in conversations about Moneylion is their secured loan. People who have tried it often mention that it feels like a really helpful tool. The way it works, you put money aside, and then at the end of a set time, that money you've been putting in actually comes back to you. It's a pretty neat setup, especially for someone looking to build up their credit without feeling like the money just disappears. You get that sense of accomplishment, you know, seeing your efforts pay off directly.

The Feel-Good Factor of Moneylion Support Reviews on Secured Loans

The idea of getting your money back after a period of using a secured loan is something that really resonates with people. It's not just about getting a loan; it's about a financial product that gives you a tangible reward for sticking with it. Users sometimes talk about the relief or satisfaction they feel when that money becomes available again. It’s almost like a financial high-five, if you will, for staying on track. This particular aspect often earns some positive remarks within Moneylion support reviews, as it stands out as a feature that delivers a clear benefit to the user.

How Do Apps Like Moneylion Compare to Other Money Tools?

There's a whole bunch of apps out there that help with quick cash or financial management, like Earnin, Dave, Credit Genie, Klover, and Cleo. And then there's Moneylion. It's pretty important to remember that these apps, including Moneylion, are not typically seen as payday loan apps. They work in a different way, offering things like cash advances based on your income or tools to help build credit. People often wonder about the distinctions, you know, how one is different from the other. It's a valid question, as each one has its own approach to helping you out financially.

- Aishaha

- Openai Chatgpt Plus Iran Purchase

- Liza Huber

- Dylan Dreyers Family News

- Chatgpt Plus Availability Iran

Distinguishing Moneylion Support Reviews from Payday Loan Apps

When people share their thoughts on Moneylion support reviews, they often point out that the service feels different from traditional payday lenders. The emphasis seems to be on helping you manage your money over time, rather than just offering a quick, high-cost fix. Users appreciate the tools that aim to improve their overall financial picture, whether it's through savings features or credit-building options. It’s really about a broader financial strategy, in a way, which some folks find more appealing than the short-term, high-interest options that are out there.

What Common Questions Do People Ask About Moneylion Support Reviews?

When people are thinking about using a service like Moneylion, a lot of questions tend to pop up. For instance, some folks wonder if the credit bureaus will get in touch with Moneylion, or what that connection even means for their credit score. Then there are practical questions, like "Why can't I get money out of my Moneylion account?" or "How long does it take for money to show up in my checking account?" People also often ask about how much money they can move around, wanting to know their Moneylion transfer limits. These are all pretty normal things to think about when you're dealing with your money, you know?

Addressing User Concerns in Moneylion Support Reviews

The questions people raise often reflect their real-world worries about financial apps. The concern about credit bureaus, for example, shows a desire to keep their credit standing healthy. When it comes to getting money out or knowing transfer limits, that's just about having control and predictability over their own funds. Users who share their experiences in Moneylion support reviews sometimes talk about how these questions were answered, or perhaps how they wished they had more clarity. It's pretty clear that transparency on these kinds of operational details is something people really value.

Are There Any Big User Concerns in Moneylion Support Reviews?

It's fair to say that not every experience with a financial service is going to be perfect, and some people do express some strong feelings about Moneylion. There are instances where individuals have said things like, "Moneylion is a giant scam," or have even mentioned gathering proof that they feel the company is, in a way, causing financial trouble for vulnerable people. These are serious claims, and they represent a different side of the user experience. It shows that while many find the service helpful, some others have had experiences that leave them feeling pretty upset and, you know, like they've been treated unfairly.

Weighing Negative Feedback in Moneylion Support Reviews

When you look at the full picture of Moneylion support reviews, it's important to acknowledge that some people have had very difficult times. These sorts of claims, about being financially disadvantaged, are something that potential users might come across. It really highlights the range of experiences out there, from those who feel very positive about the service to those who have faced significant issues. Understanding these different perspectives is, you know, a key part of getting a balanced view of what Moneylion is like for its users.

What Do Users Say About Specific Moneylion Features?

Beyond the general feelings, people often talk about specific features. For instance, someone might mention taking out a credit builder loan with Moneylion, noting that it's a 12-month program and they're, say, on month 7. They might then wonder if their progress really makes a difference. Another feature, Instacash, comes up too. Some users found it a great help when they were in a tight spot, but then they might also say that paying it back every month isn't easy, especially if they have a fixed income, like from a disability. This shows that while features can be useful, their practical application can sometimes be a bit of a challenge for individuals.

The Impact of Moneylion Features on User Lives, According to Support Reviews

The feedback on specific features in Moneylion support reviews gives us a pretty good idea of how these tools actually fit into people's lives. The credit builder loan, for example, is seen as a way to improve financial standing, but users also think about the long-term commitment. Instacash, while helpful for immediate needs, can create repayment struggles for those with consistent income limitations. It's almost like a double-edged sword, you know, offering quick relief but also requiring careful management. These personal stories really highlight the real-world effects of these financial products.

How Does Moneylion Help You Make Better Money Decisions?

Moneylion tries to offer a lot of ways to help people get smart about their money. They have a collection of ideas on how you can earn more, get money when you need it, and even win money and points by playing games. Their personal loans and tools are set up to help you keep track of your spending, save up, and work on your credit, all with the goal of helping you feel good about your financial situation. It's pretty clear they want to be a comprehensive resource, giving you different avenues to improve your money habits.

Tools for Financial Wellness in Moneylion Support Reviews

The overall aim of Moneylion, as seen in many discussions, is to empower people to take charge of their financial lives. This comes through in the way they talk about their products for borrowing, saving, and investing. The idea is to make better money decisions, giving you access to mobile banking, resources for personal finance, options for quick cash, and even rewards. Users often appreciate having these different tools in one place, which, you know, can make the whole process of managing money feel a little less overwhelming.

Is Moneylion a Real Leader in Mobile Finance?

Moneylion often presents itself as a company that's pretty significant in the world of mobile finance. They were founded back in 2013 and have reached a market of many millions of people, particularly those in the middle-income group. They see themselves as a leader in financial technology, powering new kinds of personalized products and content. They even have what they call a "super app" for consumer finance, and they also work with businesses to offer embedded finance solutions. It seems they're trying to be a pretty big player, offering a wide range of services to a lot of people.

Perceptions of Leadership in Moneylion Support Reviews

The idea of Moneylion being a leader in financial technology is something that comes up when people discuss the company. Their long history since 2013 and their large user base suggest a certain level of influence. Users who talk about Moneylion support reviews sometimes comment on the breadth of services offered, from lending to financial advice and investment options. It’s almost like they’re trying to be a one-stop shop for financial needs, which, you know, could be seen as a sign of their ambition in this space.

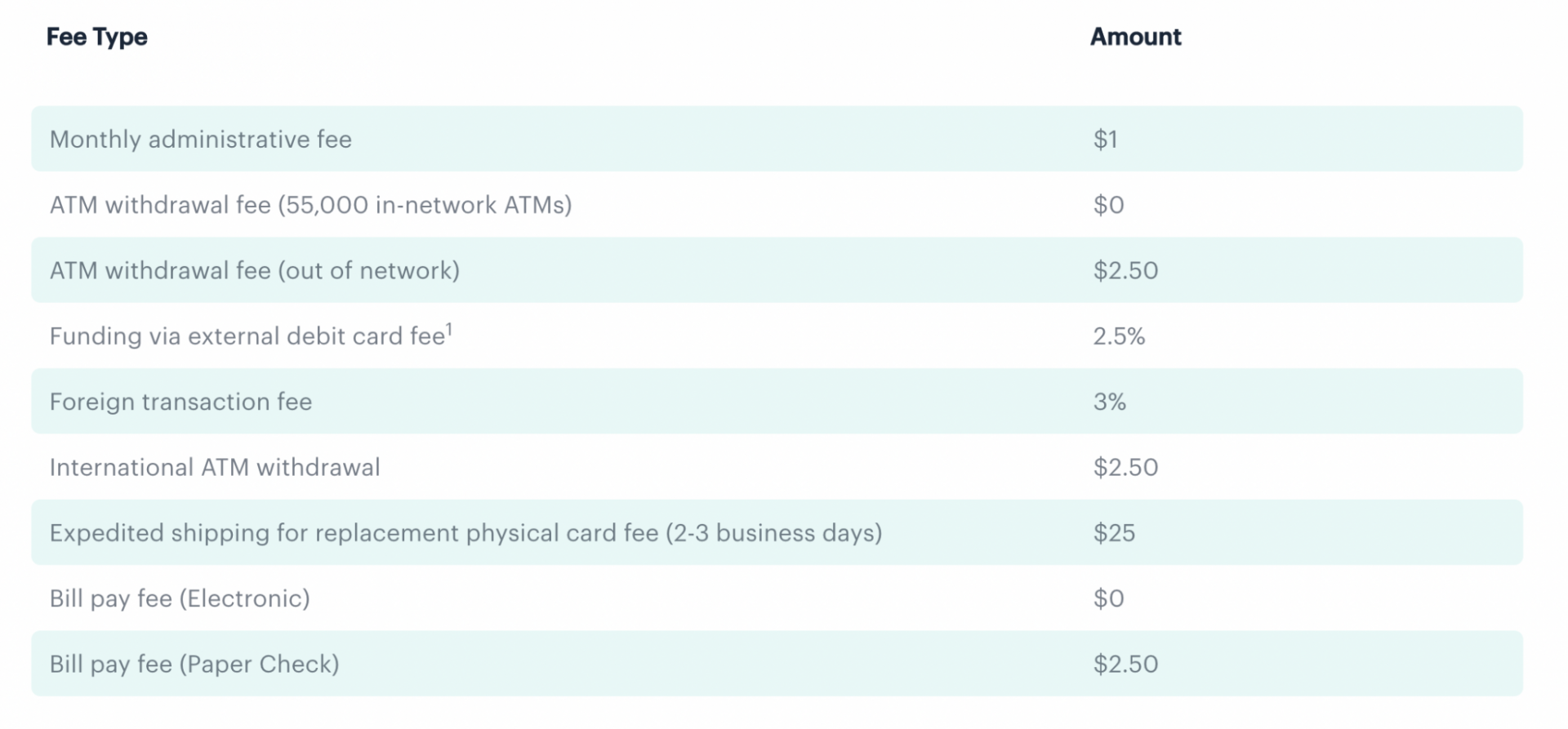

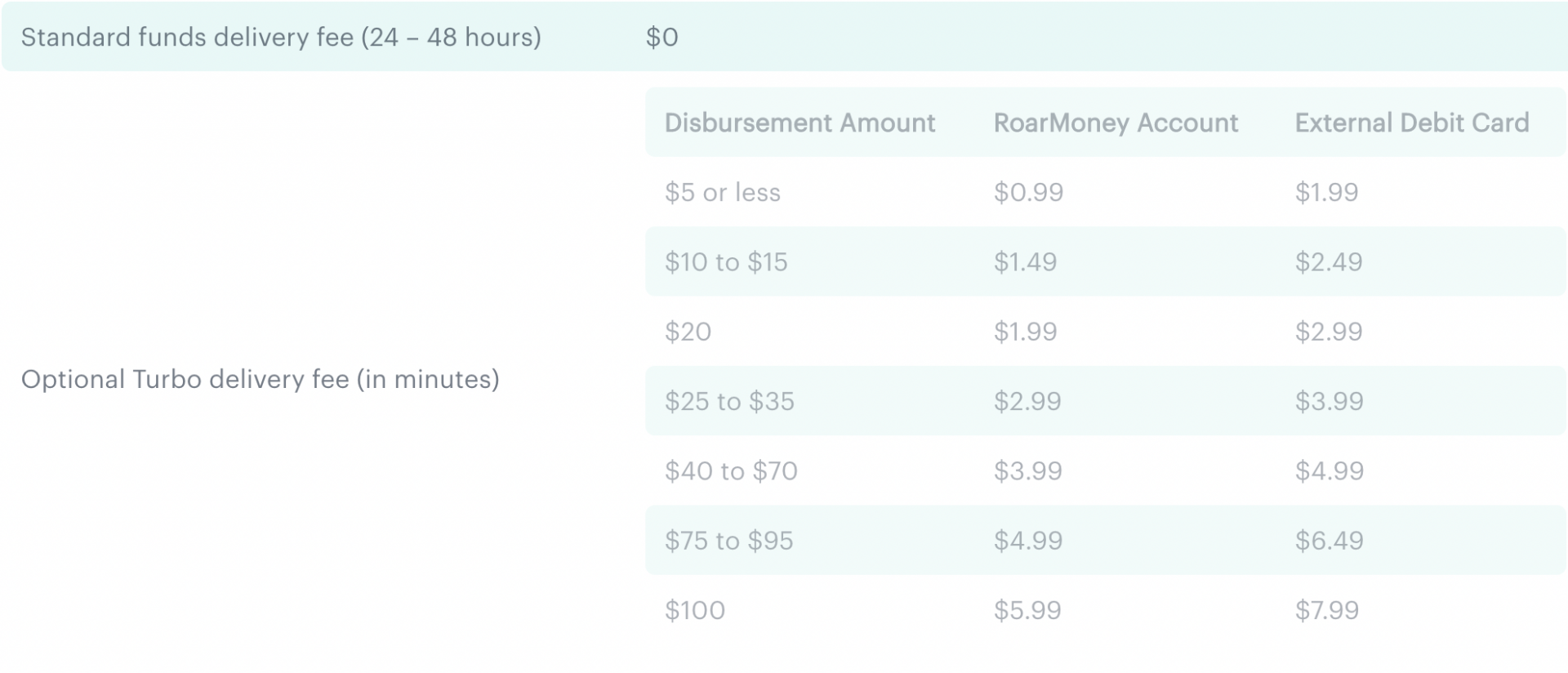

What Are the Benefits of RoarMoney, According to Moneylion Support Reviews?

A specific feature that gets attention is RoarMoney. This service is advertised as a way to earn real cashback, get paid up to two days early, and move your money pretty much when and where you want to. It's backed by Pathward®, N.A., which is a member of the FDIC, adding a layer of security. This aspect of Moneylion is often highlighted as a practical way for people to manage their everyday cash flow, offering benefits that can make a difference in how quickly they can access and use their earnings. It's a pretty straightforward offering, you know, aimed at making daily money tasks a little easier.

RoarMoney Feedback in Moneylion Support Reviews

The ability to get paid earlier and earn cashback through RoarMoney is something that users frequently appreciate. It's a tangible benefit that can help people manage their bills and expenses with a little more breathing room. The fact that it's backed by an FDIC-member institution also gives people a sense of security, which is, you know, very important when it comes to banking services. Moneylion support reviews often touch upon how these features directly impact a user's ability to handle their money with more flexibility and, you know, a bit more peace of mind.

So, we've taken a look at a range of thoughts and experiences people have shared about Moneylion. We talked about how their secured loan can feel really good when you get your money back, and how they're different from payday loan apps. We also explored the common questions people have, like about credit bureaus or getting their money out, and acknowledged that some folks have had pretty tough experiences, even calling the service a scam. We also touched on specific features like the credit builder loan and Instacash, and how they help or sometimes challenge users. Lastly, we considered how Moneylion aims to help you make better money decisions and what RoarMoney offers. It's pretty clear that for every person who finds a lot of help from Moneylion, there's someone else who might have a very different story, and that's, you know, just how it is with any widely used service.

- Was George Reeves And Christopher Reeves Related

- Robert Paul Schoonover

- Carly Jane Topless

- Jenn Pellegrino

- Dylan Dreyers Family